Tham gia Thử thách PU Xtrader ngay hôm nay

Giao dịch với vốn mô phỏng và kiếm lợi nhuận thực sau khi bạn vượt qua vòng đánh giá trader của chúng tôi.

Tham gia Thử thách PU Xtrader ngay hôm nay

Giao dịch với vốn mô phỏng và kiếm lợi nhuận thực sau khi bạn vượt qua vòng đánh giá trader của chúng tôi.

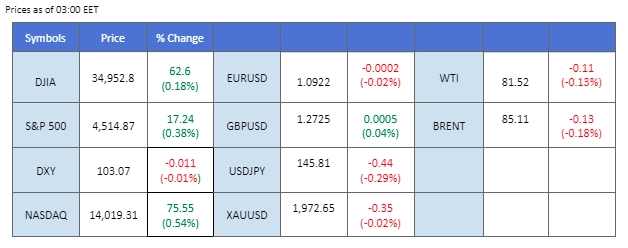

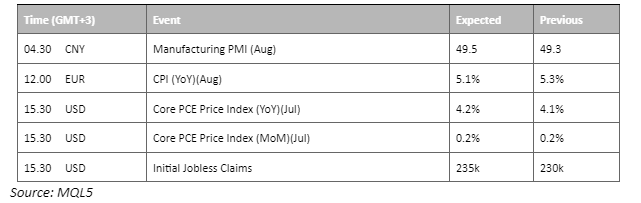

The United States continues to release disappointing economic data, leading to a further weakening of the dollar’s strength. The labour market’s cooling trend is evident as the ADP Nonfarm Employment Change figures declined to 177k, a significant drop from the previous reading of 371k. Additionally, the U.S. GDP growth fell short of market expectations, coming in at 2.1%. These developments increase the likelihood that the Federal Reserve may choose to halt its rate hike trajectory in September. Capitalising on the softer dollar, Pound Sterling and the euro experienced sharp spikes yesterday. Both gold and oil benefited from the easing dollar in the commodities market. On the other hand, China’s Manufacturing Purchasing Managers’ Index (PMI) displayed a marginal improvement, rising to 49.7 from the previous reading of 49.3. This positive economic data could potentially act as a bullish factor for oil prices.

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (89.0%) VS 25 bps (11.0%)

The Dollar Index remains downward, influenced by lacklustre U.S. economic data. The ADP Nonfarm Employment report revealed a shortfall, with figures plunging to 177k, marking a significant decline from the previous reading of 371k. Furthermore, the GDP figures failed to meet the projected 2.4% mark, settling at 2.1%. These underwhelming U.S. economic indicators have fueled market speculation that the Federal Reserve’s monetary tightening cycle might be drawing to a close, consequently diminishing the dollar’s vigour.

The dollar failed to hold above its near support at 103.4 trajectory and is struggling to find support at the $103 mark. The RSI is approaching the oversold zone while the MACD has declined to below the zero line, suggesting the bearish momentum is strong.

Resistance level: 103.40, 103.88

Support level: 102.85, 102.1

Gold prices have surged to their highest point this month and are poised for a potential breakthrough above the key psychological resistance level at $1950. The combination of lacklustre U.S. economic data and a weakened dollar has provided considerable momentum for gold’s upward movement. The prevalent signs of economic softening in the U.S. have spurred some investors to turn to safe-haven assets like gold amid global economic uncertainty.

Gold prices broke above its price consolidation range and continued to break above their near-resistance level, showing a strong bullish trend. The RSI has broken into the overbought zone while the MACD continues to surge, suggesting a bullish bias for gold.

Resistance level: 1967.00, 2000.00

Support level: 1940.00, 1900.00

The euro has effectively managed to reverse the bearish trend impacting the pair since July. Notably, the pair has surged by over 1% this week, taking advantage of the subdued dollar sentiment. While discouraging U.S. economic data has led the market to speculate on the possibility of a rate pause by the Federal Reserve in September, the eurozone’s inflation remains relatively high, notably distant from its 2% targeted rate. Of significance is the anticipated narrowing of the interest rate gap between the two currencies following the ECB’s expected rate hike in September. This potential convergence could exert a positive influence on the pair’s performance moving forward.

The EUR/USD broke above the downtrend resistance level, signalling for a strong trend reversal signal. The MACD has diverged widely while the RSI is on the brink of breaking into the overbought zone, suggesting a strong bullish momentum for the pair.

Resistance level: 1.0990, 1.1080

Support level: 1.0850, 1.0760

The Sterling has demonstrated a robust trend reversal by successfully surpassing the downtrend resistance level. The Cable managed to achieve a gain exceeding 0.6% yesterday, capitalising on the prevailing subdued dollar sentiment. This gain was prompted by the recent U.S. economic data, which fell short of market expectations. In contrast, the Bank of England (BoE) is anticipated to maintain its course of raising rates due to increased consumer borrowing and the sustained high level of inflation within the country.

The pair spiked up yesterday, stayed above its downtrend resistance level, and exhibited a strong bullish signal for the Cable. The RSI is moving toward the overbought zone while the MACD has crossed and diverged above the zero line, suggesting the bullish momentum is picking up.

Resistance level: 0.6500, 0.6580

Support level: 0.6390, 0.6320

Despite the significant 1% decline in the dollar index over the course of this week, the impact on the USD/JPY pair has been relatively subdued. The pair managed to find support around the 145.80 range. Even in the face of lacklustre U.S. labour market data and GDP growth falling short of expectations, resulting in a softer dollar, the Japanese Yen’s strength remained limited. Market sentiment regarding potential adjustments to the Bank of Japan’s ultra-loose monetary policy has diminished, with predictions suggesting such changes might not materialise this year. The substantial interest rate differential between the U.S. and Japan remains wide, suggesting the pair is likely to sustain levels above the 145 range in the longer term.

The USD/JPY pair is trading flat lately while the RSI is hovering near the 50-level suggesting a neutral signal for the pair. The MACD is declining to the zero line suggesting the bullish momentum has eased.

Resistance level: 146.40, 147.20

Support level:145.60, 144.00

The U.S. equity market maintained its rally in response to disappointing U.S. economic data, fueling a surge in risk-on sentiment among investors. The subdued economic indicators have led the market to speculate that the Federal Reserve is approaching the conclusion of its monetary tightening cycle. Additionally, notable gains were observed in shares of Visa Inc and Mastercard Inc, following their intentions to raise fees imposed on retailers.

The Dow able to hold above the then-resistance and now support level at 34800 mark exhibited a strong bullish signal. The RSI is on the brink to break into the overbought zone while the MACD has flatten suggesting the bullish momentum is slowing down.

Resistance level: 35400.00, 36000.00

Support level: 34200.00, 33600.00

The Hang Seng index maintains its upward trajectory, propelled by the prevalent risk-on sentiment seen on Wall Street. The recent release of lacklustre U.S. economic data has heightened the probability of a rate pause by the Federal Reserve, prompting investors to shift their focus to the equity market. This sentiment is mirrored across Asian equity markets. Moreover, the newly disclosed China Manufacturing Purchasing Managers’ Index (PMI) has slightly improved, moving from the previous reading of 49.3 to the current figure of 49.7. This positive development has provided impetus to the Chinese equity market, contributing to its upward movement.

The index has rebounded and has found support above its then-resistance level at 18400, demonstrating a strong bullish trend. The RSI is rising toward the overbought zone while the MACD is approaching the zero line from below, suggesting the index is trading in a bullish momentum.

Resistance level: 19130, 19860

Support level: 18400, 17600

Oil prices have discovered a source of support in the wake of disappointing U.S. economic data released this week. The signs of a softening labour market and sluggish GDP growth have contributed to a weakened dollar, which, in turn, has provided a boost to oil prices. Moreover, the recent U.S. crude oil inventories report indicated an uptick in demand for crude oil within the United States, which catalyses the upward trajectory of oil prices.

The oil prices continue to trade higher after falling to their recent low at $78. The RSI is moving toward the overbought zone while the MACD continues to move upward, suggesting a bullish bias for the oil prices.

Resistance level: 83.25, 87.25

Support level: 79.15, 76.65

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment