Tham gia Thử thách PU Xtrader ngay hôm nay

Giao dịch với vốn mô phỏng và kiếm lợi nhuận thực sau khi bạn vượt qua vòng đánh giá trader của chúng tôi.

Tham gia Thử thách PU Xtrader ngay hôm nay

Giao dịch với vốn mô phỏng và kiếm lợi nhuận thực sau khi bạn vượt qua vòng đánh giá trader của chúng tôi.

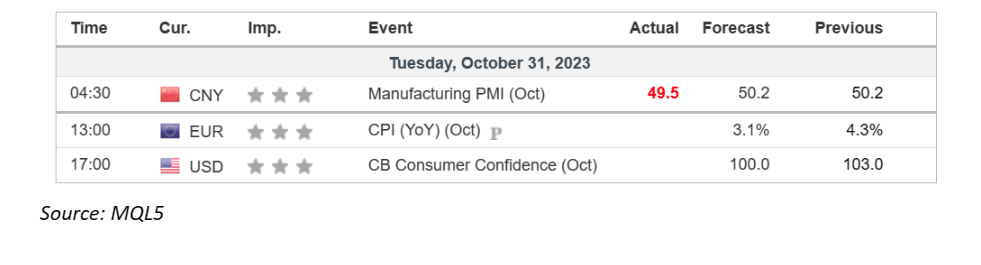

Amidst shifting global dynamics, gold prices retreated from the crucial $2000 level, pivoting attention from Middle East tensions to upcoming central bank decisions, particularly those of the Federal Reserve and the Bank of England. The dollar, influenced by market sentiment, weakened as expectations grew that the U.S. central bank might defer additional rate hikes. In stark contrast, Japan’s long-term yields reached a decade high, propelling the Japanese Yen against its counterparts, fueled by optimism surrounding a potential tweak in the Bank of Japan’s Yield Curve Control policy. Additionally, Australia’s Retail Sales data, surpassing expectations, led the Aussie dollar to gain 0.65% against the U.S. dollar.

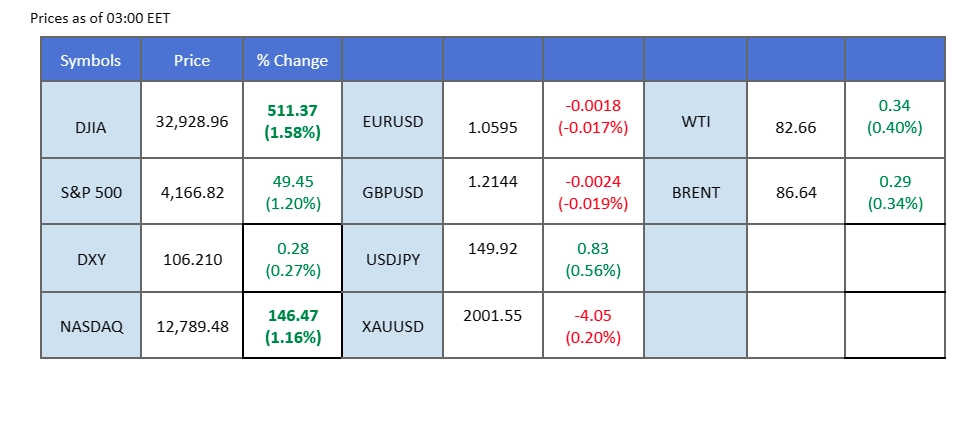

Current rate hike bets on 1st November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98.0%) VS 25 bps (2%)

Source: MQL5

With a slew of crucial events looming, including the highly anticipated Nonfarm Payrolls report and the Federal Reserve’s interest rate decision, the US Dollar undergoes a retreat, as investors opt for a wait-and-see stance amid lingering uncertainties in the US market.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 106.70, 107.15

Support level: 106.10, 105.65

Gold prices witness a retreat following a significant breach of the $2000 mark, primarily driven by technical correction. Volatility looms large ahead of key data releases, including the Nonfarm Payrolls, Unemployment Rate, and US Fed Interest Rate decisions, contributing to a cautious atmosphere for gold investors.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 58, suggesting the commodity might extend its losses toward support level since the RSI retreated sharply from overbought territory.

Resistance level: 2005.00, 2050.00

Support level: 1980.00, 1940.00

The euro made a comeback as the dollar’s strength took a breather, with investors adopting a cautious ‘wait and see’ stance ahead of the Federal Reserve’s much-anticipated interest rate decision on Wednesday. Market sentiment hinges on the central bank’s announcement. Euro investors are also keeping a keen eye on key Eurozone economic indicators, such as CPI and GDP, slated for release later today, to assess the euro’s strength in the face of these pivotal developments.

EUR/USD bearish momentum vanished yesterday and is traded toward the next resistance level at 1.0630. The RSI has climbed to above 50-level while the MACD has broken above the zero line, suggesting the bearish momentum has also waned.

Resistance level: 1.0630, 1.0700

Support level: 1.0560, 1.0500

The British Pound (GBP/USD) found respite against the previously steadfast U.S. dollar, which softened as the eagerly awaited Federal Reserve interest rate decision drew near. Market sentiment leans towards the Fed holding off on rate hikes. Similarly, the Bank of England is anticipated to maintain its current interest rate level, given the lacklustre UK economic performance in October. Investors closely monitor the ADP Nonfarm Employment Change, which could sway the Cable’s movements amid these pivotal developments.

Despite a technical rebound, the Cable is still trading in a lower high price pattern, suggesting a bearish trend for the Cable. The RSI has rebounded from below, while the MACD is approaching the zero line from below, indicating the bearish momentum has eased.

Resistance level: 1.2300, 1.2565

Support level: 1.2060, 1.1830

In a noteworthy trend reversal, the Dow Jones Industrial Average has broken free from its downtrend channel, signalling a potential shift in market sentiment. The index experienced a robust rebound, surging by over 500 points, amidst a significant reduction in risk-off sentiment linked to Middle East tensions. Market optimism was further bolstered by expectations that the Federal Reserve might postpone interest rate hikes, given the elevated levels of the U.S. long-term bond yield.

The Dow rebounded and has broken above the downtrend channel, suggesting a trend reversal for the index. The RSI has rebounded strongly from above the oversold zone while the MACD has crossed from below and is approaching the zero line, suggesting a bullish momentum is forming.

Resistance level: 33750.00, 34600.00

Support level: 32700.00, 31900.00

The Japanese Yen (JPY/USD) exhibited a robust performance against the U.S. dollar in anticipation of the Bank of Japan’s (BoJ) imminent interest rate decision. Market chatter intensified as Japan’s long-term bond yield hit a decade-high, nearing the 1% Yield Curve Control (YCC) ceiling. Speculation grew that the BoJ might adjust its YCC policy, yet experts suggest the central bank may delay scrapping its negative interest rate policy until next year. The decision hinges on demonstrating sustainable wage growth and inflation in Japan.

USD/JPY is trading in a wide price consolidation range and has broken below due to fundamental factors. The RSI is approaching the oversold zone, and the MACD has broken below the zero line, suggesting the bullish momentum has waned.

Resistance level: 150.40, 151.50

Support level: 148.55, 147.50

The AUD/USD pair surged following the release of robust Australian economic data on Monday, breaking free from its long-term downtrend resistance level. However, the Aussie dollar faced headwinds due to lacklustre Chinese economic data that was freshly released, dampening its bullish momentum. Investors are now keenly watching the upcoming ADP Nonfarm Employment Change data, which could influence the AUD/USD pair.

AUD/USD has broken above its long-term downtrend resistance level, given a trend reversal signal for the pair. The RSI has eased from climbing upward while the MACD has flown above the zero line, suggesting the bullish momentum is still forming.

Resistance level: 0.6395, 0.6510

Support level: 0.6300, 0.6205

Middle East tensions take a backseat as investors pivot towards the Federal Reserve’s imminent monetary outlook, prompting a tumble in oil prices. Lingering uncertainties persist, warranting a cautious approach in the energy market.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 39, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 89.35, 94.00

Support level: 82.50, 78.15

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment

Đăng ký mới không khả dụng

Hiện tại chúng tôi không chấp nhận đăng ký mới.

Mặc dù không thể đăng ký mới, các người dùng hiện tại vẫn có thể tiếp tục các thử thách và hoạt động giao dịch như bình thường.