Tham gia Thử thách PU Xtrader ngay hôm nay

Giao dịch với vốn mô phỏng và kiếm lợi nhuận thực sau khi bạn vượt qua vòng đánh giá trader của chúng tôi.

Tham gia Thử thách PU Xtrader ngay hôm nay

Giao dịch với vốn mô phỏng và kiếm lợi nhuận thực sau khi bạn vượt qua vòng đánh giá trader của chúng tôi.

21 June 2023,05:48

Daily Market Analysis

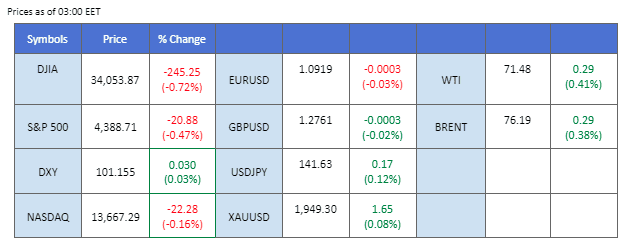

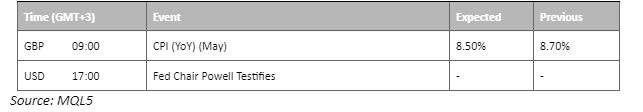

The market is exhibiting cautious sentiment as it edged lower in anticipation of Fed Chair Jerome Powell delivering his semi-annual monetary policy report before the House today (21st June). Investors closely scrutinise this two-day testimony to gain insights into the Fed’s future actions. Meanwhile, the Japanese yen experienced high volatility amid rumours of potential intervention by the Bank of Japan due to the yen trading at a seven-month low against the dollar. Elsewhere, market attention is focused on the UK’s inflation data, as the Bank of England is expected to raise interest rates on 22nd June. A higher Consumer Price Index (CPI) reading may support Sterling’s trading at higher levels.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (26%) VS 25 bps (74%)

The release of upbeat economic data, including the surge in building permits, has led to a surge in the US dollar’s value. According to the US Census Bureau, building permits in the United States experienced a substantial surge from 1.147 million to 1.491 million in May. This surge exceeded market expectations of 1.425 million, marking the largest increase in more than three decades. The surge in building permits indicates renewed strength and potential growth in the housing market.

The dollar index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 45, suggesting the index might be traded lower as technical correction since the RSI stays below the midline.

Resistance level: 102.70, 103.30

Support level: 101.95, 100.80

Gold prices retreated as the US Dollar gained ground on the back of positive economic data. The release of impressive building permits figures, surpassing market expectations and registering the largest increase in over 30 years, bolstered the value of the US Dollar. According to the US Census Bureau, building permits surged from 1.147 million to 1.491 million in May, indicating renewed vigour and growth potential in the housing market. The appreciation of the US Dollar acted as a headwind for gold prices, prompting a retreat from previous levels.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 40, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 1960.00, 1995.00

Support level: 1930.00, 1905.00

The Euro stays relatively flat this week ahead of Jerome Powell’s 2-days testimony before the House of Representatives starting later today (21st June). Any Hawkish stance he releases in the 2 days event may support the dollar to trade higher, pressuring the Euro. On top of that, the dollar gained some strength after the Housing data in the U.S. was released. The U.S. Housing Starts showed the housing market in the country has signs of rebound which may strengthen the dollar.

On the technical front, the Euro successfully held above Fibonacci 23.6%, showing the Euro’s strength is strong. However, the RSI is declining along with the MACD depicting that the bullish momentum for Euro is diminishing.

Resistance level: 1.0947, 1.0981

Support level: 1.0891, 1.0842

The USD/JPY pair experienced a slight easing as the Japanese Yen appreciated, driven by remarks from Japan’s Industry Minister urging the Bank of Japan to intervene in the currency market if the Yen continues to weaken. This statement has sparked speculation among investors, as they closely monitor the potential actions of the central bank. Market participants are now focused on any signs of intervention by the Bank of Japan, which could have significant implications for the USD/JPY pair and currency markets.

USD/JPY is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 55, suggesting the pair might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 141.90, 143.20

Support level: 140.20, 138.85

Pound Sterling maintained its upward trajectory despite experiencing some technical retracement for the past few days. The dollar gained slightly after the housing market data showed signs of recovery in the country. On the other hand, the UK’s CPI is much anticipated by the market, while the market expects the inflation in the UK to show signs of moderating. A higher-than-expected CPI may bolster the sterling to trade higher against the USD.

GBP/USD is experiencing a technical retracement after a strong bullish rum for the past weeks. The RSI has declined from the overbought zone while the MACD has crossed above the zero line suggesting a trend reversal for the cable.

Resistance level: 1.2888, 1.3020

Support level: 1.2655, 1.2550

The Dow Jones Industrial Average retraced from a significant resistance level, with the energy sector acting as a drag on the index’s performance. Oil giants Exxon Mobil Corp and Chevron Corp faced persistent selling pressure, reflecting the bleak outlook for the oil and gas industries amidst uncertainties surrounding the global economic recovery. Furthermore, the US equity market extended its losses as investors grappled with lingering uncertainties ahead of Federal Reserve Chairman Jerome Powell’s testimony. Market participants eagerly await Powell’s remarks, particularly focusing on his stance regarding the potential resumption of interest rate hikes following the recent pause.

The Dow is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 55, suggesting the index might extend its losses toward support level since the RSI retreated sharply from overbought territory.

Resistance level: 34255.00, 35250.00

Support level: 33265.00, 32450.00

Forecasts highlighting a deceleration in China’s oil demand have contributed to the extended losses in oil prices. Experts at China National Petroleum’s research arm have revised their expectations downward, attributing the shift to the growing popularity of electric vehicles, which has led to reduced gasoline consumption. On the supply side, despite U.S. sanctions, Iran has managed to achieve new highs in both crude exports and oil production this year. The resilience of Iran’s oil sector has added to the downward pressure on oil prices, as increased supply from the country counters efforts by OPEC and its allies to stabilise the market through production cuts.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 52, suggesting the commodity might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 74.20, 76.75

Support level: 70.70, 67.20

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment

Đăng ký mới không khả dụng

Hiện tại chúng tôi không chấp nhận đăng ký mới.

Mặc dù không thể đăng ký mới, các người dùng hiện tại vẫn có thể tiếp tục các thử thách và hoạt động giao dịch như bình thường.