Tham gia Thử thách PU Xtrader ngay hôm nay

Giao dịch với vốn mô phỏng và kiếm lợi nhuận thực sau khi bạn vượt qua vòng đánh giá trader của chúng tôi.

Tham gia Thử thách PU Xtrader ngay hôm nay

Giao dịch với vốn mô phỏng và kiếm lợi nhuận thực sau khi bạn vượt qua vòng đánh giá trader của chúng tôi.

5 April 2023,05:59

Daily Market Analysis

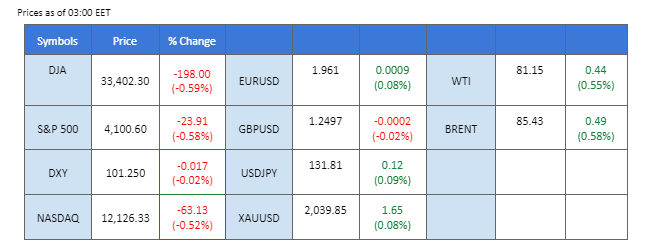

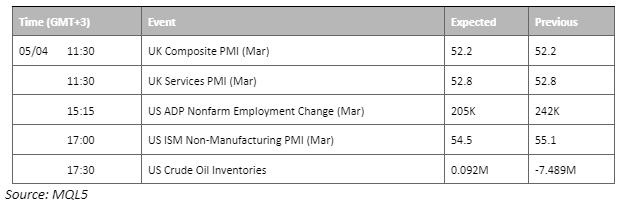

Although a hawkish statement from Cleveland Fed President Loretta Mester advocated for sustained rates above 5%; the market is struggling with the resurgence of banking fears. The newly released economic data, including the manufacturing PMI and JOLTs job opening data showed that the economic activity in the U.S. showed signs of stagnation, which has repercussions on the banking system crisis. Meanwhile, the dollar index traded below $102 while gold prices hit a record high with the story that Fed might be pausing rate hikes to fine-tune the situation. On the other hand, oil prices poised above $81, topped with lower-than-expected U.S. crude inventories after OPEC+’s surprise supply cuts. In addition, New Zealand’s central bank raised the interest rate by another 50 bps, and the New Zealand dollar gained more than 0.6% against the U.S. dollar.

Current rate hike bets on 3rd May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (57.3%) VS 25 bps (42.7%)

The Dollar Index, which gauges the greenback’s strength against a basket of six major currencies, tumbled to a two-month low on Tuesday, as discouraging economic data fuelled speculation that the Federal Reserve’s tightening cycle is nearing its peak. A sharp drop in US job openings in February to their lowest level in almost two years, and a decline in factory orders, are dampening market sentiment towards the US economy. The latest monthly Job Openings and Labor Turnover Survey (JOLTs) report showed a decrease of 632,000 to 9.9 million in job openings, a critical measure of labour demand, falling well below market expectations of 10.4 million.

The Dollar Index is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 31, suggesting the index might enter oversold territory.

Resistance level: 102.90, 103.50

Support level: 101.95, 100.85

Gold prices have soared past the $2,000 psychological level and are heading towards a new record high as investor sentiment towards the global economic outlook remains pessimistic. At the same time, the US Dollar is facing significant bearish pressure due to a series of underwhelming economic data releases, which have led to a decline in US yields. The yield on two-year Treasury bonds has dropped by 12 basis points to 3.86%, as short-term interest rate expectations are now lower. Additionally, a weaker dollar often signals a lack of confidence in the US economy, which further boosts the appeal of gold as a safe-haven asset.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 73, suggesting the commodity might enter overbought territory.

Resistance level: 2025.00, 2045.00

Support level: 2000.00, 1970.00

The euro went up against the dollar mainly due to the weakening U.S. dollar, where the dollar traded below $102 for the 1st time in 2 months. After releasing the lower-than-expected U.S. manufacturing PMI data, the freshly released job data show that the job opening has hit its lowest level in 2 years, dragging the dollar to trade lower. These economic data reinforced the investors to believe that the Fed may end its monetary tightening program especially after the upheaval of the banking sector weeks earlier. In addition, the ADP nonfarm payroll is expected to be released later today, a lower-than-expected figure may hammer the dollar to trade lower.

The indicators show a bullish signal for the pair; the RSI constantly stayed above the 50-level and moved toward the overbought zone while the MACD diverged above the zero line.

Resistance level: 1.1055, 1.1144

Support level: 1.0867, 1.0796

The New Zealand Dollar soared in the wake of the Reserve Bank of New Zealand’s decidedly hawkish stance towards the economic landscape. In a surprising move during the early hours of Asian trading, the central bank of New Zealand raised interest rates by a noteworthy 50 basis points, keeping its pace of tightening intact as a measure to combat inflation, despite the global economy’s current trajectory towards a potential recession.

NZDUSD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 70, suggesting the pair might enter overbought territory.

Resistance level: 0.6355, 0.6415

Support level: 0.6285, 0.6190

The pound surged on Tuesday, rose to $1.25 for the first time since June 2022. It is the highest level in ten months against a weakening dollar as traders turned bullish on a currency trading well below 2016. The central bank’s chief economist signalled more interest rate hikes. The Bank of England Chief Economist Huw Pill said they still cannot be sure it has raised interest rates enough to tame inflation. On the other hand, BoE monetary policymaker Silvana Tenreyro said the central bank would probably need to start cutting interest rates sooner than previously thought, but that didn’t stop the sterling rally.

The pound hit 1.2525 at once on Tuesday trading, indicating a strong bullish trend ahead. As we mentioned yesterday, it has already broken above the crucial level of 1.2425, and it could extend its rally. MACD illustrates a bullish momentum. RSI is at 69, which indicates a bullish momentum ahead.

Resistance level: 1.2613, 1.2740

Support level: 1.2425, 1.2298

The U.S. stock market closed lower on Tuesday after data showed a cooling economy exacerbated worries that the Federal Reserve’s campaign to rein in decades-high inflation may cause a deep downturn. Moreover, data showed U.S. job openings in February dropped to the lowest level in nearly two years, suggesting that the labour market was cooling. The number of job openings has decreased, making people worry that hiring is going too slow, which will be bad for the economy. To be more exact, investors can wait for more economic data to be released for further trading signals.

The Dow Jone Index is trading on the sideline, and market participants are awaiting the release of more data. MACD has illustrated a bullish momentum ahead. RSI is at 66, also indicating a bullish momentum ahead.

Resistance level: 34310.00, 35640.00

Support level: 32875.00, 31600.00

Oil prices are maintaining their upward momentum, buoyed by a weakened US Dollar, and encouraging inventory data. The recent pessimistic US economic data has lowered expectations of aggressive interest rate hikes by the Federal Reserve, causing US Treasury yields to fall further and decreasing demand for the US Dollar. In terms of inventory levels, US crude stockpiles recorded their second consecutive weekly decline last week. According to the American Petroleum Institute, US crude inventories potentially fell by 4.346 million barrels during the week ended March 31st, surpassing market expectations of a decline of 1.8 million barrels.

Crude oil prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 76, suggesting the commodity might enter overbought territory.

Resistance level: 81.05, 85.45

Support level: 77.25, 73.80

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment

Đăng ký mới không khả dụng

Hiện tại chúng tôi không chấp nhận đăng ký mới.

Mặc dù không thể đăng ký mới, các người dùng hiện tại vẫn có thể tiếp tục các thử thách và hoạt động giao dịch như bình thường.